Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

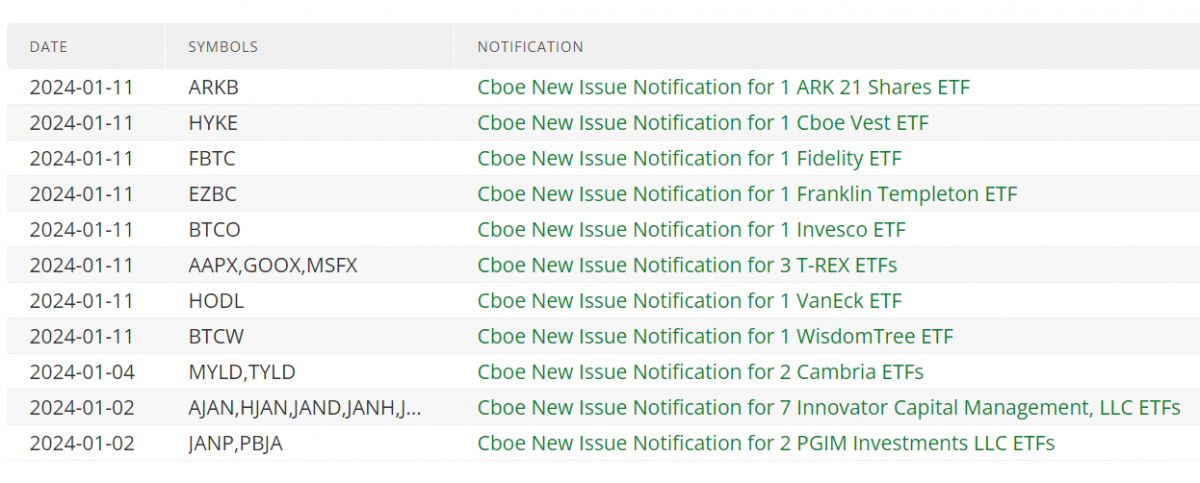

The Securities and Exchange Commission (SEC) is set to make a decision today on the fate of a Bitcoin spot ETF. If approved, trading will commence on the Chicago Board Options Exchange (CBOE) at 9:30 am on January 11th. While the SEC has not officially announced their decision on the Bitcoin spot ETF approval, proponents of a bullish Bitcoin market believe that the ETF would have a positive impact on Bitcoin supply and investment sentiment.

Bitcoin bulls anticipate a surge in new capital inflows if the Bitcoin spot ETF is approved. BITO, the largest ETF since its listing in October 2021, has already secured approximately $2 billion in net assets. Market experts at GTS predict that the listing of the Bitcoin spot ETF could attract $200-300 billion in new funds within a month and $1-2 trillion annually. While this influx of new funds may not significantly affect Bitcoin’s $900 billion market capitalization, it is expected to improve investment sentiment as Bitcoin gains symbolic recognition in regulated markets.

Houthi rebels in Yemen have intensified attacks on civilian ships in the Honghai region. On January 10th, the US Central Command reported that the rebels had launched ballistic missiles towards international shipping routes, marking the 26th attack on commercial vessels. This recent attack is the largest in scale since the start of ship attacks last year. While specific cases of damage have not been reported, concerns about increased risks in the Honghai region have raised worries about rising freight transportation costs.

The potential blockade of the Honghai route by Houthi rebels poses a threat to global supply chains and could lead to an increase in freight transportation costs. John Gold, Vice President of Supply Chain at the US Retail Federation, warns that shipping companies have already raised freight rates due to restrictions in the Suez Canal and drought in the Panama region. If trans-Pacific shipping is further restricted, freight rates could reach their highest levels since early 2022.

BlackRock, the world’s largest asset management company, has announced plans to reduce its workforce by approximately 3% in a move to streamline operations and improve efficiency. Meanwhile, Hewlett Packard Enterprise (HPE) plans to strengthen its market position by acquiring Juniper Networks for approximately $14 billion. In the semiconductor industry, Taiwan Semiconductor Manufacturing Company (TSMC) has reported fourth-quarter revenue of $201 billion, surpassing analysts’ expectations. This impressive revenue is attributed to the strong demand for chips, particularly in the AI sector.

The decisions regarding the Bitcoin spot ETF, the escalation of the Honghai dispute, and the developments in the financial and technology sectors have had a significant impact on the global market. Investors and industry experts are closely monitoring these events as they shape investment sentiment, trading dynamics, and the future of digital currencies.

If you’re wondering where the article came from!

#